Back in March, InMobi ran a mobile survey using InMobi Pulse, InMobi’s mobile market research solution, to see how Americans across the U.S. were reacting to the COVID-19 pandemic. Of course, a lot has changed across the nation since we first conducted this survey in March. So, what does the current landscape look like today?

To find out, InMobi ran another mobile survey. This time, we directly surveyed over 1,500 adults in the U.S., asking them the same questions we asked back in March. The survey, which reached individuals in every corner of the country (see note below), ran from April 2 to the 10th and had the same representation in terms of age and gender as the last survey.

Here’s what else the survey reveals about the current state of the nation regarding COVID-19.

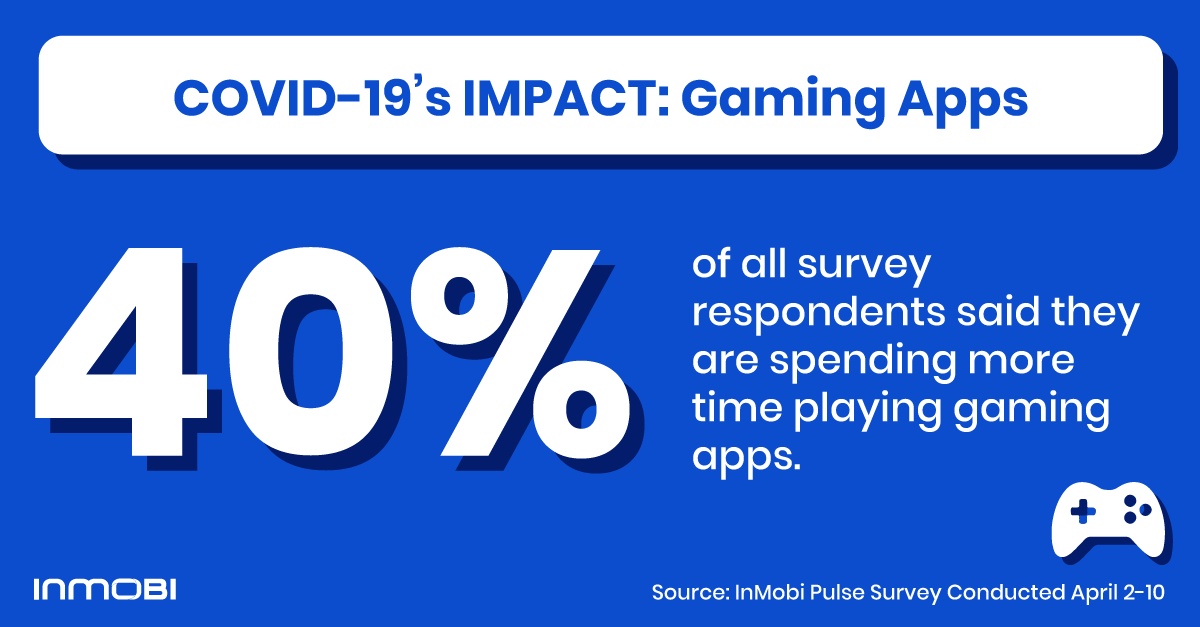

In early April, 40% of all survey respondents said they are spending more time playing gaming apps. Between March and April, there was an increase in share of respondents between the ages of 36 to 45 and people between56 and 65 that said they were playing mobile games more frequently. In April, 45% of survey respondents with kids in the house are using mobile gaming apps more frequently.

Social apps usage is especially high among younger people. In fact, 66% of survey respondents aged between 18 to 25 said they are spending more time using social apps since the coronavirus outbreak first started in the U.S. and over a third of survey respondents in this age range in April said they are using communication apps more frequently.

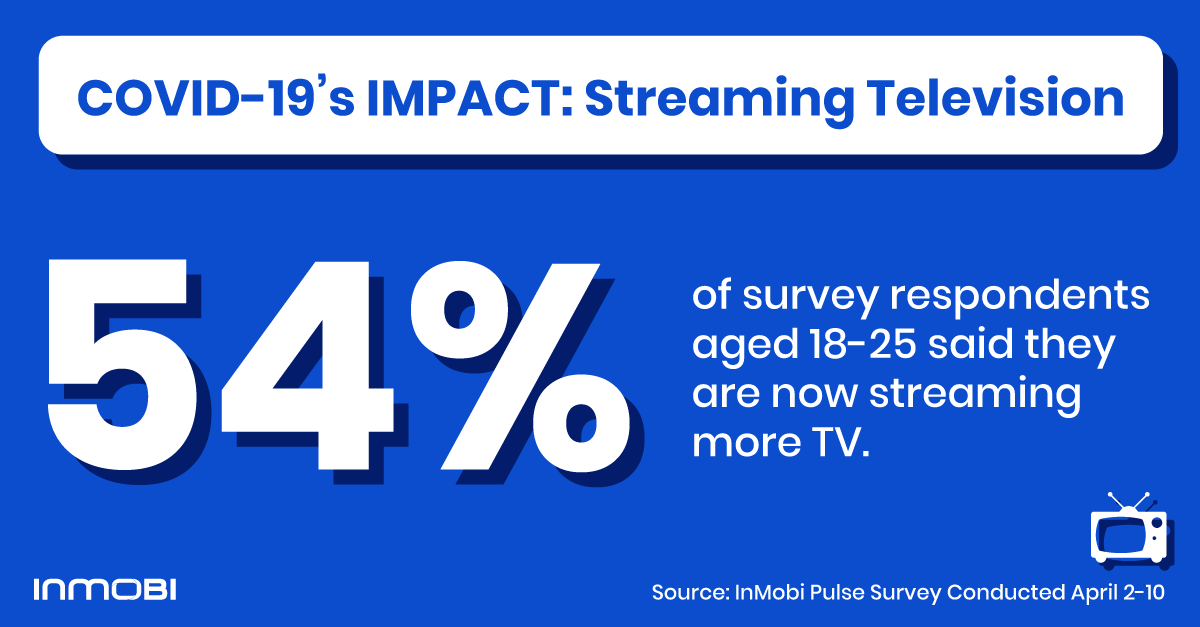

The percentage of people who report streaming more TV content across devices now has notably increased, jumping from 25% in March to 33% in early April. In fact, this month, 54% of survey respondents aged 18-25 said they are now streaming more TV. Connected TV usage is growing at a rapid clip, with many people now accessing video content through different apps and services across multiple devices, including television sets.

Around one in four people surveyed this month said they are watching more live TV. The percentage of people aged between 46 to 55 who said they are watching more live television rose significantly from 17% in March to 29% in early April.

Last time, only 61% of people surveyed said they were very strictly reducing contact with others. Thankfully, that figure has now shot up to 79% of survey respondents.

A major difference between then and now is with people between 36 and 45 years old. In our first survey, only 57% of respondents in this age range said they were strictly avoiding contact with others. In the latest survey, this figure grew to 82% of respondents among this group.

Overall, women are more than likely than men to be strictly avoiding others. Older respondents are slightly more likely than younger survey respondents to be practicing social distancing.

One in five people said they were laid off or furloughed this time around, up from17% from our last survey. Women are more likely to be not working now, with a quarter of all women polled in April now saying they have been furloughed or laid off. And, 28% of survey respondents between the ages of 18 and 25 now say they are out of work.

Among those that still have jobs, over one in four are now working from home. The number of people who are required to work from home jumped from 16% to 20% this time around, with women and younger people being the most likely to be working from home right now.

Among the work-from-home crowd, 24% of survey respondents now say they are using Zoom. Last time around, it was only 13%. People across all ages and genders are using Zoom more frequently in April compared to March. Microsoft Teams also saw a significant increase in usage, albeit smaller than Zoom.

Overall, among early April survey respondents, 37% said they have not increased spending. This is down from March, when 47% said they had not increased spending. Only 17% of survey respondents in April said they have not decreased spending.

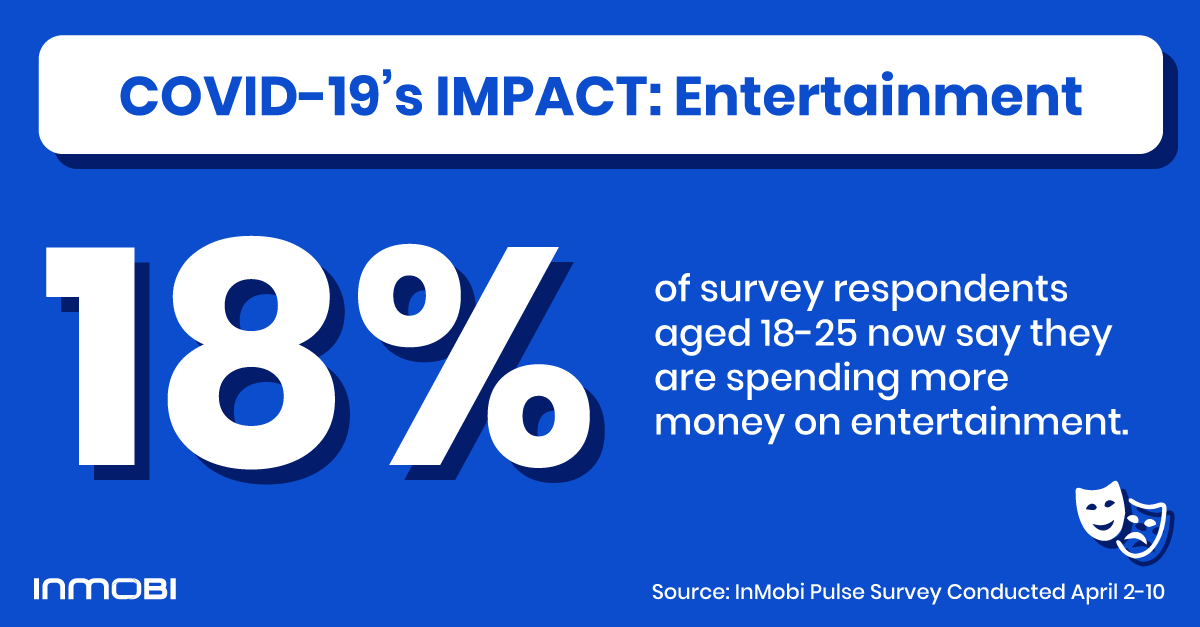

According to the early April survey results, 35% said they are spending less on clothes, shoes and jewelry. Around a third said they are spending less on entertainment, and over a third have decreased spending on travel and transportation.

There are some areas where survey respondents are spending more. For instance, 18% of survey respondents aged between 18 to 25 now say they are spending more on entertainment. And, the percent of male survey respondents who said they have decreased spending on entertainment went from 36% in March down to 29% in April.

In early April, 50% of survey respondents said they are not shopping online more frequently, with people 56 years old and above being less likely than their younger peers to say this.

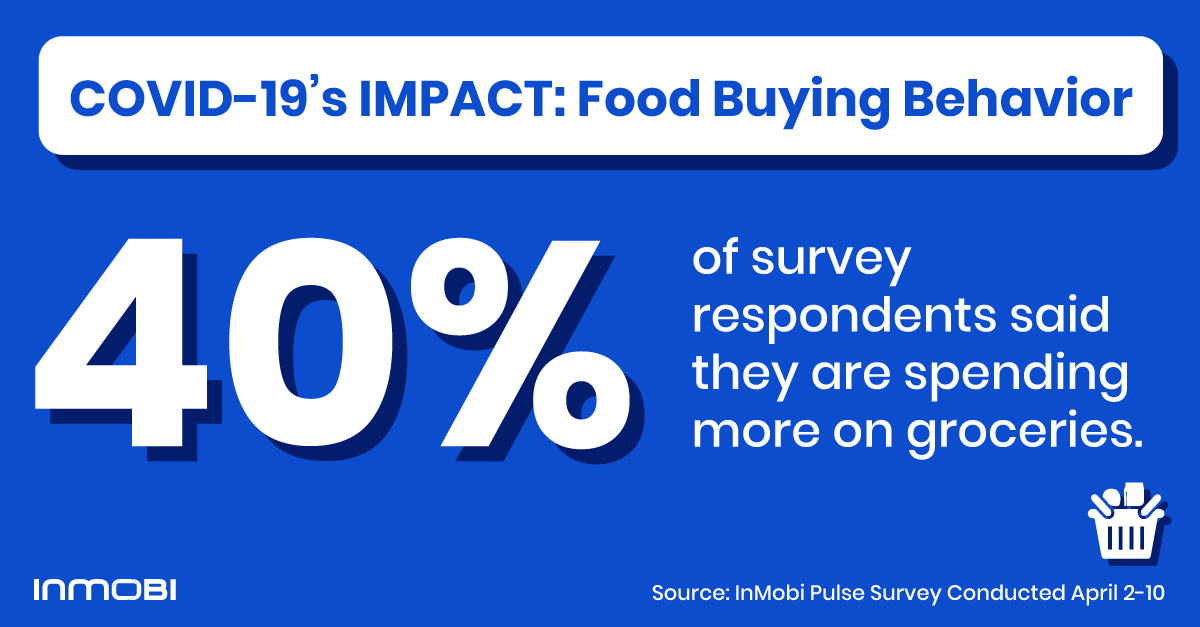

In early April, 40% of survey respondents said they are spending more on groceries of late. But, only 17% of survey respondents said they are buying groceries online.

Close to half of survey respondents aged 46 to 55 said they are spending more on groceries now. This may be because over a third of those in this age group have started cooking from home due to COVID-19. Overall, among all survey respondents in April, 30% said they are cooking at home more frequently now.

According to our latest survey, 27% of respondents said they have stocked up on enough groceries for a month, up from 18% in March. Last month, 32% of survey respondents said they didn’t change their grocery buying habits at all; in April, only 22% of survey respondents said the same thing.

According to our April survey, 20% of respondents said they have reduced or stopped ordering food for delivery or takeout. The percentage of survey respondents aged 18 to 24 who have decreased their delivery and takeout behavior went from 12% in March to 24% in early April.

According to the April survey results, 36% of respondents said COVID-19 will impact their behaviors for the next two to three months. Between March and April, the biggest jump was in the share of survey respondents who said their behavior will be impacted for the next six to 12 months.

The survey responses in April reflects the ever-changing nature of the pandemic. But, no matter how long we are all sheltering in place, we will definitely continue looking closely at these trends.

Interested in more COVID-19 insights? Head to www.inmobi.com/covid-19 for data and analysis on how the world is coping with the pandemic, how it’s affecting consumer behavior and how marketers are advertisers are reacting to a rapidly changing landscape.

Note: 37% of survey respondents in April were from the Southern U.S. 23% were from the Midwest, 19% were from the Western U.S. and 15% were from the Northeast. The remaining survey respondents elected not to indicate where they live.